Norway is poised for a transformative year in 2025, with forecasts pointing to three defining trends: accelerated green-energy exports, a surge in Arctic sea traffic, and a structural recalibration of the national economy.

First, green-energy exports are expected to triple as new sub-sea cables link Norwegian hydropower to Germany and the United Kingdom. Statnett’s updated grid model predicts that surplus hydro and onshore wind could deliver up to 42 TWh abroad—equal to powering 10 million European homes—pushing electricity prices in southern Norway temporarily above 60 €/MWh for the first time since 2018.

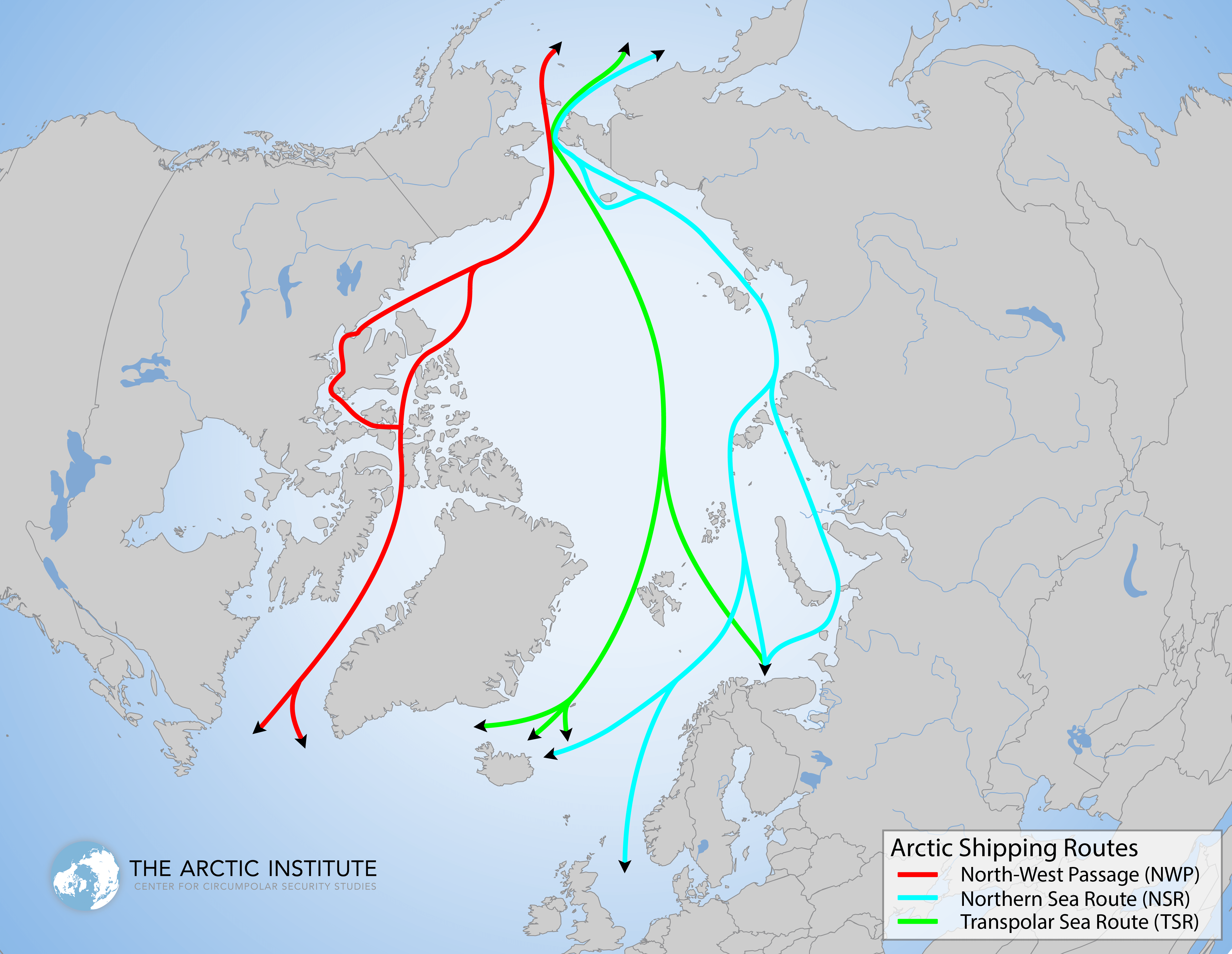

Second, the Northern Sea Route is seeing record ice retreat. The Norwegian Meteorological Institute’s seasonal outlook indicates a 35 % probability that the route will remain ice-free for eight consecutive weeks next summer. If realized, transit times from Yokohama to Rotterdam could fall to 18 days, compared with 34 days via Suez. Oslo-based DNV forecasts that Norwegian ports along the west Finnmark coast could handle 1.2 million TEU by 2026, up from 120 000 TEU in 2023, triggering demand for at least 4 000 new high-latitude maritime jobs.

Third, mainland GDP growth is projected to slow to 1.1 % as petroleum investment plateaus and monetary policy stays tight. However, non-oil exports—ranging from batteries to aquaculture technology—are set to expand 5.8 %, narrowing the current-account surplus to 10 % of GDP, still the highest in Europe. The Government Pension Fund Global is expected to transfer 2.8 % of its capital to the treasury, down from 3.0 % in 2024, reflecting a cautious fiscal stance amid higher domestic spending on hydrogen corridors and carbon-capture clusters.

Taken together, these developments suggest Norway’s role is shifting from hydrocarbon frontier to green-energy and Arctic-logistics hub, a transition that investors and policymakers alike will watch minute by minute through 2025.